Virgin Money is the new disruptive force in UK banking. Bringing together the combined history and expertise of Clydesdale Bank, Yorkshire Bank and Virgin Money. It is the only bank outside the ‘Big 5’ that boasts a genuine full-service personal and business banking capability.

Serving 6.6 million customers across the UK through a digital-first approach that offers leading online and mobile services, supported by telephone and branch banking, including a national network of branches and business banking centres. It is structured around three divisions – personal, mortgages and business – offering a full range of products and services for consumers and small and medium sized businesses, delivered through its leading technology platform to deliver a consistently world class experience for customers.

Its ambition is clear – to make Virgin Money a new force in consumer and business banking that will disrupt the status quo.

Virgin Money is an official signatory to the United Nations (UN) Principles for Responsible Banking, a single framework for a sustainable banking industry developed through an innovative partnership between banks worldwide and the UN’s Finance Initiative. The plan is to embed sustainability into all of the Group’s business practices so that it can realise the long-term opportunities of being a sustainable business, while mitigating risks from climate change and social inequality.

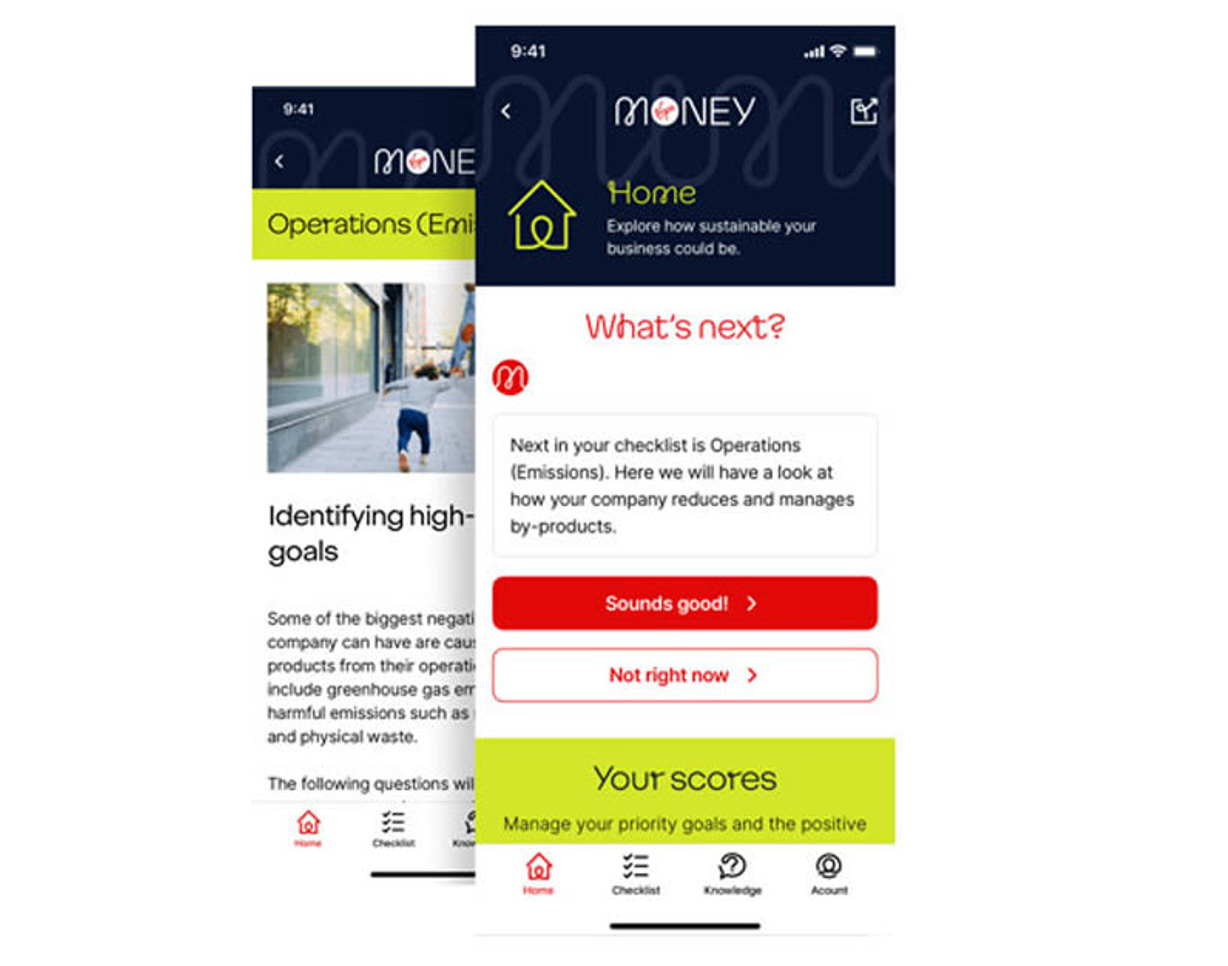

Virgin Money has committed that 5% of business lending balances, in the medium-term, will be to companies who are pro-actively enhancing sustainability. Partnering with Future-Fit Foundation provides a fantastic opportunity to progress towards the Group’s market commitment and entrench a sustainability mindset throughout the organisation.

As an established provider of finance and facilitator of business growth, Virgin Money will continue to work closely with the Future-Fit team to ensure the challenges and opportunities for SME businesses can be identified and addressed. The bank will also explore adapting the Future-Fit methodology for its customer base and beyond, so companies can identify action points to enhance their ESG position, as well as providing thought leadership and additional benefits for businesses at the forefront of sustainability.